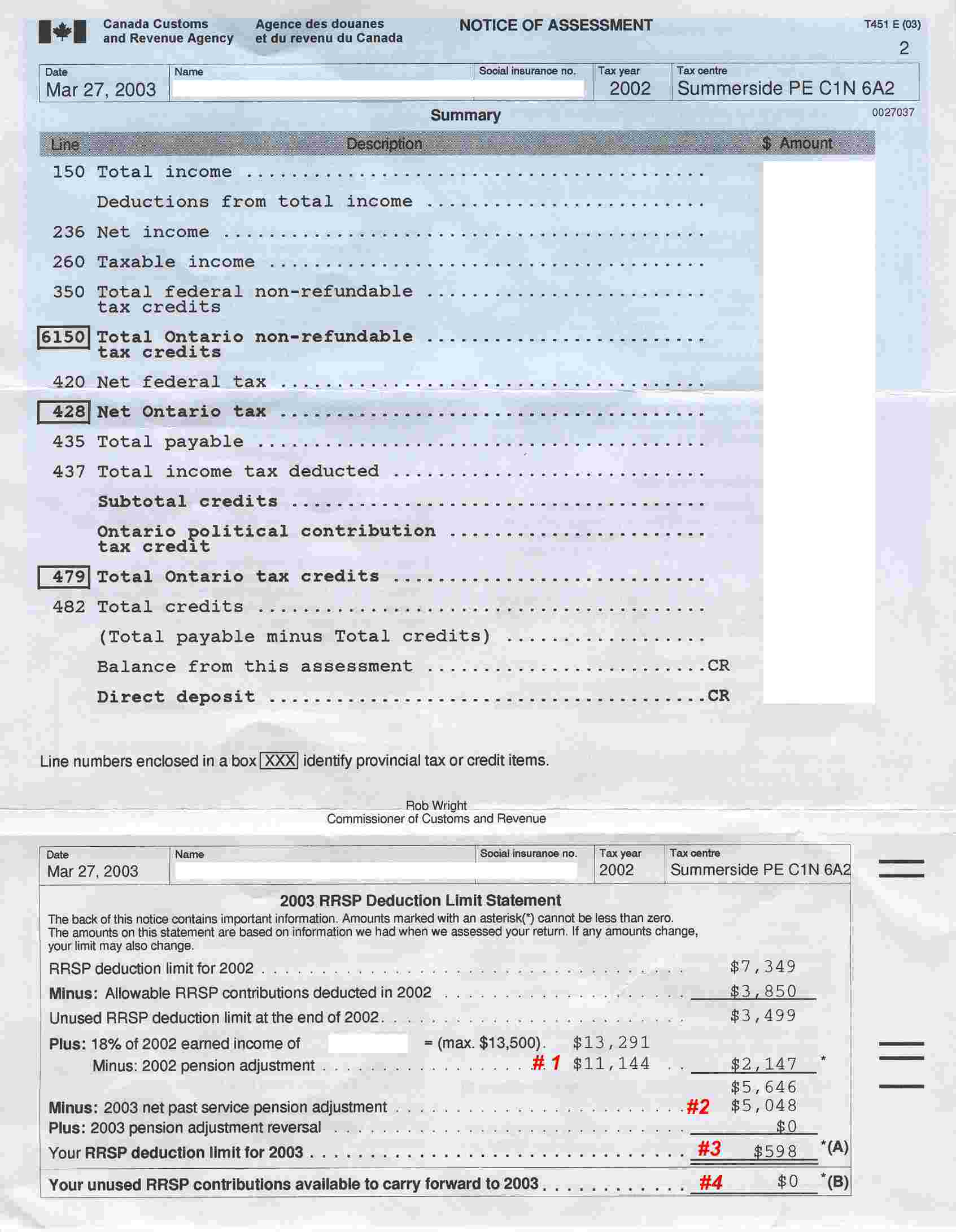

2003 RRSP Deduction Limit Statement

Your RRSP deduction limit for 2003 (# 3, line A) is the maximum amount you can deduct on your 2003 income tax return for contributions you made to an RRSP after 1990 and before March 2, 2004. This deduction limit applies to contributions to your RRSP or to an RRSP for your spouse or common-Iaw partner for which we have not previously allowed you a deduction. In addition:

| The maximum amount you can deduct is over and above any deductions you can claim for allowable transfers to an RRSP. | |

| If you turn 69 during 2003, you can only contribute to your RRSP until the end of 2003. | |

| If your spouse or common-Iaw partner turns 69 during 2003 you can only contribute to his or her RRSP until the end of 2003. |

Your pension adjustment (# 1), past service pension adjustment (# 2), and pension adjustment reversal are amounts your employer or pension administrator calculated. For more information, see your employer or pension administrator.

Your unused RRSP contributions available to carry forward to 2003 (# 4, line B) are RRSP contributions that you could not deduct or which you chose not to deduct on your 2002 return. Report these contributions on line 1 of your 2003 Schedule 7. You can carry forward this amount and use it as a deduction on a future return up to your RRSP deduction limit for that year.

If your unused RRSP contributions available for 2003 plus any contributions you make during 2003 are greater than your 2003 RRSP deduction limit, you may be subject to a penalty tax on the amount over $2,000.

(Source: the back of the Notice of Assessment form)